The United Kingdom has a robust and thriving automotive market, making it one of Europe’s largest for new cars. With 32.7 million cars on UK roads and an average of 1.2 cars per household, cars are an integral part of British life. However, the market for car manufacturers has been affected by the COVID-19 pandemic, making it more crucial than ever to know what you’re doing when purchasing a vehicle. Here’s your comprehensive guide to buying a car in the UK.

Eligibility

Anyone with a home address in the UK can buy a car. The legal driving age is 17, and there are no specific residency requirements for foreign nationals. You’ll need a UK address to register, tax, and insure the car, but otherwise, it’s relatively straightforward.

To Buy New or Used?

There’s a significant debate over buying a new or used (secondhand, as the Brits say) car online. New cars come with long warranties and often include the latest in fuel-saving and safety technologies. Used cars can be considerably cheaper and are especially plentiful in the UK market. With nearly-new models available at significant discounts, you might find a compromise that suits you.

Payment Options

When buying a new car, you’ll have numerous payment options, including cash, credit cards, personal loans, hire purchases, and various leasing options. Independent consumer magazines like Which? advise shopping around for the best finance deals and being prepared to negotiate with the dealer.

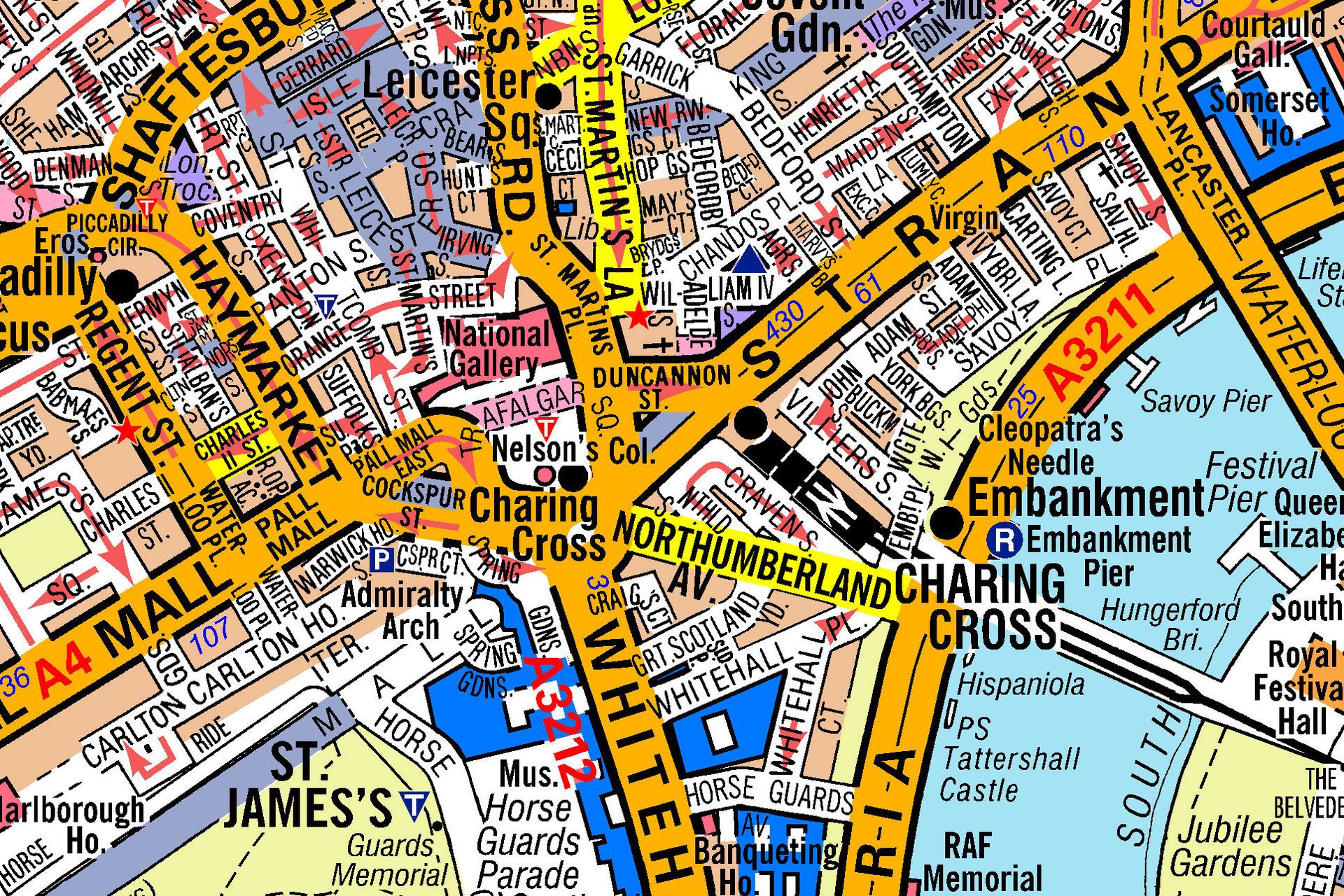

Where to Buy?

Dealerships

The UK has approximately 5,000 franchised car dealerships, so you will likely find one near you. Playing dealers off against each other can help you get the best price and finance package.

Online Platforms

Several websites specialise in new and used cars. AutoTrader, Cazoo, and Carwow are among the most popular. These platforms have the added benefit of online finance calculators and plenty of reviews.

Buying a Used Car: Points to Consider

If you opt for a used car, it’s vital to do your due diligence. Check the car’s registration number, MOT test number, mileage, and make and model against DVLA’s records. Always make sure you receive the car history check, original logbook (V5C registration certificate) and valid MOT test documents. You may also consider a private history check to make sure the car hasn’t been stolen or previously written off.

Online Protections

If you decide to go the online route for your purchase, you have similar rights as you would in a physical dealership. You can cancel your order within 14 days of the car’s delivery and have another 14 days to return it for a full refund.

Ongoing Costs

MOT Certificate

Any car over three years old must have a valid MOT certificate, which needs to be renewed annually. The maximum fee for an MOT is £54.85, but many garages offer better prices.

Vehicle Tax

The UK’s car tax system is designed to encourage eco-friendly driving. Rates vary widely based on factors such as CO2 emissions and the car’s age.

Insurance

Driving without insurance is illegal in the UK. Policies range from bare-minimum cover for injuries to third parties to fully comprehensive packages.

Fuel Costs

Fuel prices can vary, but electric cars generally offer lower running costs than their petrol or diesel counterparts.

Selling Your Car

When it’s time to part with your vehicle, you have various options: private sale, auction, trade-in, or using a service specializing in buying used cars. Just make sure to comply with all government regulations during the process.

Additional Considerations

Green Cars and the Environment

With increasing concerns about climate change, many buyers are turning to electric vehicles (EVs) and hybrids. The UK Government plans to ban the sale of new petrol and diesel cars by 2030, making it wise to consider a green option now. Incentives such as grants and lower tax rates make EVs more attractive, although you’ll need to consider charging infrastructure.

Extras and Customization

When purchasing a new car, you’ll often have the option to add extras like advanced navigation systems, heated seats, or extended warranties. Be wary of getting carried away, as these can quickly inflate the price.

Test Driving

Whether you’re a cheap car, buying new or used, always take the car for a test drive. This will help you assess its condition and how comfortable you feel driving it.

Car Reviews

Don’t underestimate the importance of reading reviews and watching videos of the make and model you’re considering. Websites like AutoExpress, Carbuyer, and Top Gear offer valuable insights.

Price Negotiation

Haggling is entirely acceptable when buying a car in the UK, whether from a dealership or privately. If you’ve done your homework, you’ll be in a strong position to negotiate the price.

Paperwork and Legalities

Once you’ve decided on a car, you’ll need to fill out some paperwork to make the sale legal. This includes the V5C, which must be updated with your vehicle’s registration number and details and sent to the DVLA. Failure to do this could result in a fine.

Delivery and Collection

Many dealerships offer delivery services, sometimes free of charge. Alternatively, you may need to arrange to pick up the car yourself.

Consumer Rights

The Consumer Rights Act 2015 provides protection for buyers, allowing you to return a faulty car within 30 days for a full refund. If you’re buying used, these rights can differ, so be sure to understand what protections you have.

Insurance for Young Drivers

Young drivers often face high insurance premiums. It may be worth looking at cars in low insurance groups and considering options like telematics (black box) insurance to lower costs.

After-Sales Service

After you’ve purchased your car, it’s essential to maintain it well. Many dealerships offer after-sales services and annual maintenance packages. These can give you peace of mind but always read the terms and conditions carefully.

Financing Options for Your Car Purchase

One crucial aspect that many buyers ponder is how to finance their car purchase. If you’re not paying outright with cash, you’ll likely need to explore various car finance options. Financing allows you to spread the cost of your car over several months or years, typically by paying a fixed monthly cost or instalment. Interest rates and contract terms can vary, so make sure to read the fine print and consider the overall cost, not just the monthly payment. Many dealerships partner with finance companies to offer loans directly, but you can also arrange your own through banks or online lenders.

[car_finance_form]Our car finance calculator helps you see how much your car loan repayments will be on a monthly basis.

Simply select how much you are looking to borrow and for how long.

Bad Credit Van Finance

If you’re considering buying a van but have a poor credit history, don’t lose hope. Many finance options are tailored specifically for those with less-than-perfect credit scores. Bad credit van finance schemes can be a lifeline for individuals or businesses that need a van but can’t secure a traditional loan. However, it’s essential to remember that these options often come with higher interest rates and stricter terms to offset the lender’s risk. So, if you’re opting for this route, ensure you can meet the financial commitments to avoid worsening your credit score.

Bad Credit Car Finance

Similarly, a subpar credit history doesn’t necessarily bar you from owning a car. You can explore bad credit car finance options designed to cater to people who might find it challenging to secure a traditional loan. As with bad credit van finance, the terms will likely be less favourable, with higher interest rates and a higher initial deposit required. Before going down this route, it would be wise to assess your financial situation thoroughly and consult with a financial advisor to understand the long-term implications.

Importance of a Test Drive and Vehicle Inspection

Once you’ve sorted out your finance options, it’s time to get back to the vehicle itself. No matter how good a deal seems on paper, never skip the test drive and vehicle inspection. It’s an opportunity to ensure the car handles well, is comfortable, and is free of any glaring issues. Remember, a car is a long-term investment. It’s better to spend some time now rather than discovering issues later that could cost you significantly.

Maintenance and Aftercare

Your relationship with the car doesn’t end once you’ve made the purchase; you’ll need to think about maintenance and aftercare. Check what sort of warranty or aftercare package comes with your purchase and consider extended warranties if you think it’s necessary. Regular servicing is crucial, not just to keep the car running but also to maintain its resale value should you wish to sell it later.

Vehicle Insurance and Road Tax

In the UK, it’s compulsory to have vehicle insurance before you drive your new car off the lot. The cost of car insurance can vary based on various factors like your age, driving history, and the type of car you’ve bought. Don’t forget about the road tax, either. The cost is based on the car’s emissions, and you can usually pay it annually, biannually, or monthly.

Final Words

Buying a car, whether new or used, is often a significant financial commitment, especially when you factor in the additional costs like insurance, road tax, and maintenance. Therefore, it’s essential to plan carefully, understand your options for car finance, and consider schemes like bad credit car finance or bad credit van car finance deals, if your credit history is less than stellar.

By approaching the car-buying process with due diligence and a thorough understanding of your options, you can make a well-informed decision that serves you well for years to come. Always remember that while the initial purchase is significant, the long-term costs of owning a car can add up, so budget accordingly and drive safely.

Extended FAQs

Q: What factors should I consider when buying a car?

A: When buying a car, consider the vehicle’s age, make, model, fuel efficiency, maintenance cost, insurance premiums, and your own budget. Additionally, explore various car finance options to find the one best suited for you.

Q: Is it better to buy a new car or a used one?

A: Both have their pros and cons. New cars come with the latest features and lower maintenance costs but depreciate quickly. Used cars are more affordable upfront but might require more frequent repairs.

Q: How do I calculate the total cost of ownership?

A: Add up the initial cost, insurance premiums, fuel expenses, maintenance costs, and any loan interest if you’re opting for finance. Don’t forget to subtract the estimated resale value to get the total cost of ownership.

Q: What is a credit score and how does it affect my car purchase?

A: A credit score is a numerical representation of your creditworthiness. A good score can help you secure better car finance options, while a bad score might lead you to bad credit car finance or bad credit van finance options, which could be more expensive.

Q: Can I get finance options even with a bad credit score?

A: Yes, there are specialised bad credit car finance and bad credit van finance options, though they often come with higher interest rates.

Q: How do I improve my credit score before buying a car?

A: You can improve your credit score by paying off outstanding debts, maintaining a good payment history, and avoiding new credit applications in the short term.

Q: What is a down payment, and how much should it be?

A: A down payment is an upfront amount you pay when purchasing a car. The more you can put down, the less you’ll have to finance, potentially securing a lower interest rate.

Q: Is leasing a good option?

A: Leasing allows you to drive a new car every few years but doesn’t result in ownership. It can be a good option if you prefer lower monthly payments and driving newer models but aren’t concerned about building equity.

Q: Should I negotiate the price with the dealer?

A: Absolutely, it’s always advisable to negotiate. Dealers often have a margin for negotiation, so don’t hesitate to ask for a better deal.

Q: What if I need a car for my business? Are there specialised options?

A: Yes, if you need a van for your business and have a less-than-perfect credit history, you might find bad credit van finance company options suitable.

Q: Are there any government schemes or tax incentives for buying green vehicles?

A: Some governments offer tax incentives for electric or hybrid vehicles. It’s best to check the current schemes available in your area.

Q: Where can I find more information about car finance options?

A: Our article already provides a comprehensive overview of car costs, but you can also consult car finance experts for personalised advice.

Q: What is APR and how does it affect my car loan?

A: APR stands for Annual Percentage Rate, which is the cost of borrowing over a year, including the interest rate and additional fees. A lower APR generally means you’ll pay less over the life of the loan.

Q: Can I refinance my car loan?

A: Yes, refinancing is an option if you find a lender offering a lower interest rate than your current loan. This could reduce your monthly payments and the total cost of the loan.

Q: What are balloon payments?

A: A balloon payment is a large, lump-sum payment scheduled at the end of a loan term. While this can reduce your monthly payments, it can be a financial burden if you’re not prepared for it.

Q: What’s the difference between secured and unsecured car loans?

A: A secured loan requires collateral, usually the car itself, which means the lender can repossess the vehicle if you default. An unsecured loan doesn’t require collateral but usually comes with higher interest rates.

Q: How does the loan term affect my monthly payments and the total cost?

A: A longer loan term will reduce your monthly payments but increase the total interest you’ll pay over the life of the loan. A shorter term has higher monthly payments but lowers the total cost.

Q: What is a guarantor loan?

A: A guarantor loan is a type of personal loan where another person commits to paying back the loan if you cannot. This is often an option for those with poor credit.

Q: Is zero-percent financing a good deal?

A: Zero-percent financing offers no interest, but these deals are generally reserved for new cars and individuals with excellent credit. They might also require a larger down payment.

Q: Can I return the car if I’m not satisfied?

A: Some dealers offer a “cooling-off” period, but this is not universal. Always read the purchase agreement carefully to understand your options.

Q: What are the consequences of defaulting on a car loan?

A: Defaulting can lead to the repossession of your car, a drop in your credit score, and potential legal consequences.

Q: How do warranties and after-sales services work?

A: Warranties cover specific repairs for a set period. After-sales services may include free maintenance and other perks. Both can vary widely by the car dealer and should be considered when comparing options.

Q: Do I need GAP insurance?

A: GAP (Guaranteed Asset Protection) insurance covers the difference between the market value of your car and the remaining loan amount if your car is totalled. It’s an additional cost but provides extra security.

Q: Can I trade in my old car when buying a new one?

A: Most dealers offer trade-in options where the value of your old car’s history part is deducted from the price of the new one. Just ensure you know the market value of your old car to negotiate effectively.

By addressing these frequently asked questions, you’ll not only gain a deeper insight into the complexities of buying a car but also learn how to navigate your way to a deal that best suits your needs and circumstances.

Key Takeaways

- When considering financing options, thoroughly research to find the best fit for your circumstances.

- Bad credit history is not an insurmountable obstacle; specialised finance options are available.

- Always understand any finance agreement’s full terms and implications, especially if you have a bad credit history.

Final Thoughts

Whether you’re a first-time buyer or adding another vehicle to your collection, the process of purchasing a car in the UK can be complex but rewarding. With the various buying and financing options available, you’re sure to find something that fits your needs and budget. Just remember to read the fine print, understand your consumer rights, and perhaps most importantly, enjoy the ride!

By adhering to the guidelines outlined in this comprehensive guide, you can confidently navigate the intricacies of car buying, even if your financial history is less than perfect. Happy motoring!