Car finance is a handy solution for anyone looking for an uncomplicated means to afford a vehicle that would otherwise be out of reach.

The main types of finance for car purchases are:

- Personal Contract Purchase (PCP)

- Hire Purchase (HP)

- Personal Loan

- Leasing (Personal Contract Hire)

- 0% Finance

- Conditional Sale

- Credit Card

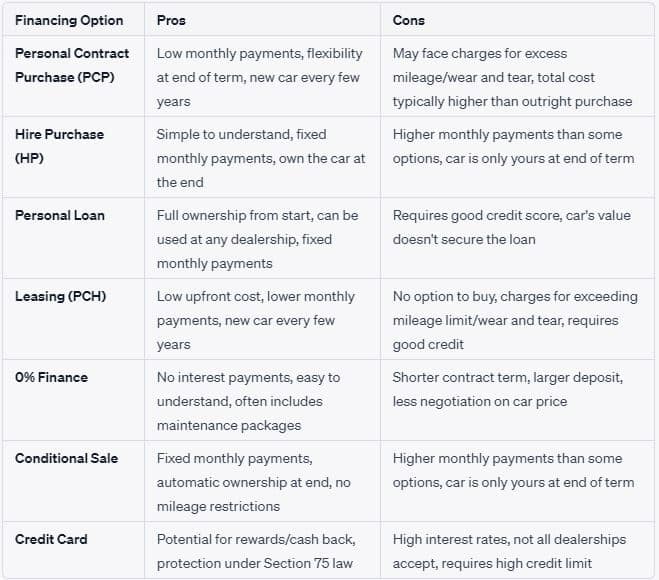

Each type of car finance has its own pros and cons, and recognising them is key to finding the right option for your financial circumstances. Read on for an overview of each so you can make an informed decision when selecting a personal finance plan that helps you to buy the car that you want.

Personal Contract Purchase

A common type of finance in car purchases is the Personal Contract Purchase (PCP).

The key features of this finance option are:

- Initial deposit payment

- Fixed monthly payments over a specified term (usually 2-4 years)

- At the end of the term, three options:

- Make a final ‘balloon’ payment to buy the car outright

- Return the car to the dealer without further charges (if in good condition and within the agreed mileage)

- Part-exchange the car for a new model at the dealership

- Offers flexibility and allows customers to defer ownership decision

Overview of PCP

In a PCP agreement, you will typically pay in an initial deposit, typically a percentage of the car’s total price. Following this, you will continue with fixed monthly payments over a pre-agreed term, often spanning 2 to 4 years. These payments contribute towards the depreciation of the car’s value during the contract period, rather than its total cost.

At the end of the payment term, the car doesn’t necessarily transfer to you as the buyer. You have the option to make a final, ‘balloon’ payment, return the car, or part exchange the car at the dealership for a new model.

The balloon payment, also known as the Guaranteed Minimum Future Value or GMFV, effectively buys the car outright and the cost of this is predetermined at the beginning of the contract. If you decide to return the car to the dealer, you will face no further charges, provided the car is in good condition and hasn’t exceeded the agreed mileage limit. When opting to part-exchange the car at the dealership, if the vehicle’s market value is more than the remaining balloon payment, the difference can be used as a deposit on the new car.

The versatility offered by PCP, allowing customers to change their car regularly, defer the decision of ownership, or eventually own a vehicle, makes it an incredibly popular choice among different types of finance.

Hire Purchase

- Initial deposit

- Fixed monthly payments over a specified term (usually 1-5 years)

- All payments contribute towards owning the car outright

- No end-of-term decisions; the car becomes yours after final payment

- Ideal for those preferring a simple path to car ownership

Hire Purchase, also known as HP, is another popular car financing option that’s simple and straightforward, offering you a clear path to outright ownership.

With an HP agreement, you start by paying an initial deposit. This deposit is usually a percentage of the car’s full price. Following this, you make fixed monthly payments over an agreed term, often between 1 to 5 years.

The crucial difference between HP and other types of car finance options like PCP is that there are no end-of-term decisions to make. Every payment you make is going towards owning the car outright.

Once all the payments have been made at the end of the contract, the car becomes yours – there are no balloon payments or decisions about returning or replacing the car. You automatically become the full legal owner of the car once the final payment is made.

Hire Purchase is an ideal choice if you prefer a simple method to spread the cost of car ownership.

Personal Loan For Financing A Car

- Borrow a set amount from a bank or other lender

- Repay in fixed monthly instalments over a specified term

- Unsecured loan not tied to the car’s value

- Full ownership of the car from the start

- Best suited for those with a good credit score

A Personal Loan is a versatile option for car finance. You borrow a set amount from a lender, such as a bank or a credit union, which is then paid back in fixed monthly instalments over a period that typically ranges from 1 to 7 years. The loan is unsecured, meaning it’s not tied to the value of the car and can be a good option if you have a strong credit rating and want full ownership of the car from the start.

Leasing (Personal Contract Hire)

- Deposit followed by fixed monthly payments

- Rent the car for a set period (typically 2-4 years)

- Return the car at the end of the term

- Great for enjoying new cars and avoiding resale hassles

Personal Contract Hire (PCH), also commonly known as car leasing, is a long-term rental agreement. It offers you the opportunity to drive a brand-new car without worrying about its depreciation or the hassle of selling it later.

The PCH process begins with you paying an initial rental fee or deposit, typically equivalent to three, six, or nine monthly payments. Following this upfront payment, you will make fixed monthly payments throughout the lease term, which generally lasts between 2 to 4 years, depending on your agreement.

The monthly payments on a PCH agreement don’t contribute towards car ownership. Instead, they cover the vehicle’s depreciation during the lease term. The amount of your monthly payment will depend on a variety of factors, including the car’s value, the duration of your contract, and the agreed mileage limit.

It’s important to remember that a PCH agreement usually includes a stipulated annual mileage limit. Exceeding this mileage limits can result in additional charges, and you’ll also need to keep the car in good condition to avoid any end-of-contract charges.

When the lease term ends, you simply return the car to the leasing company. You don’t have to worry about selling the car or its residual value. If you want to continue driving a new vehicle, you can start a new lease agreement.

Try Our Car Finance Calculator

0% Finance For Car Purchases

- Borrow the cost of the car and repay with no interest

- Usually offered by dealerships

- Pay only the car cost plus any fees

- Often requires a large deposit

- A good credit score is typically needed

0% Finance deals are where you borrow the cost of the car and pay it back without any interest. These are typically offered by dealerships and mean that the cost you pay for the car (plus any fees) is all you pay. It’s an attractive option if you have a good credit score, but it’s worth noting these deals can require a large deposit.

Conditional Sale Financing

- Pay a deposit then repay the balance in monthly instalments

- Own the car automatically at the end of the repayment period

- No option to return the car to the lender

- A straightforward path to car ownership

A Conditional Sale agreement is similar to Hire Purchase, but you automatically own the car at the end of the repayment period. There’s no option to return the car to the lender. You pay a deposit, then repay the balance in equal monthly payments or instalments over a set period.

Car Financing By Credit Card

- Only an option if you have a high credit limit

- Good if you can get a card with a 0% interest period

- Must pay off the balance before the interest-free period ends

- Some dealers may charge fees or not accept credit cards

If you have a high enough credit limit, you might be able to buy a car with a credit card. This could be a good option if you can get a card with a 0% interest period, but you’ll need to pay off the balance before the interest-free period ends. Some dealers may charge a fee for credit card payments, or may not accept this payment method at all.

How To Choose The Right Finance Option

Choosing the right finance option for purchasing a car depends on various personal circumstances and preferences. Here are a few factors that might help you decide:

Budget: Your budget will play a significant role in determining which finance option is right for you. Some finance options, like Hire Purchase (HP) or a Personal Loan, usually require higher monthly payments but lead to outright car ownership. On the other hand, Personal Contract Purchase (PCP) or leasing (PCH) often come with lower monthly payments, but you won’t own the car at the end of the agreement unless you make a final large payment (in the case of PCP).

Future Plans: If you enjoy driving the latest models and change cars every few years, a PCP or leasing might be a good option. If you want to own a car without the hassle of selling it later, consider a Hire Purchase.

Mileage: If you drive a lot of miles each year, getting your next car on a lease might not be the best choice, as it usually includes a mileage limit, and you may face excess mileage charges. HP, Personal Loan, or Conditional Sale might be more suitable.

Credit Score: Your credit rating will impact your eligibility for certain finance options. If you have a good credit score, you’ll likely have more options open to you, including more favourable interest rates.

Upfront Costs: Some options may require a larger deposit upfront (like 0% finance deals or sometimes PCP deals), which can be a significant initial outlay.

Remember, it’s important to fully understand the terms and conditions of any finance agreement before you sign it. Ensure you can comfortably meet the monthly payments and consider the total cost over the term of the agreement, not just the monthly payment. It’s often helpful to get advice from a financial advisor or a knowledgeable person if you’re unsure about anything.

Summary

Deciding between the different types of finance available to you when buying a new car can seem overwhelming but you should now have an overview of each, along with the pros and cons involved so you can make an informed decision on the right one for you.

To recap you can choose between:

- Personal Contract Purchase (PCP), offering flexibility with lower monthly payments;

- Hire Purchase (HP), providing straightforward ownership options;

- Personal Loans, which can be used at any dealership;

- Leasing or Personal Contract Hire (PCH), is a suitable choice for those who prefer regularly changing vehicles;

- 0% Finance, for a no-interest payment option;

- Conditional Sale, guaranteeing automatic ownership at the end of the term; and

- Credit Card purchases, that might offer reward schemes.

At carvine.co.uk, we pride ourselves on being a reputable and trusted provider of car finance solutions. Our mission is to equip you with the information necessary to make informed decisions when it comes to vehicle financing.

FAQs

Can I finance a car if I have a poor credit score?

Yes, it’s possible to finance a car with a poor credit score, although your options may be more limited, and the interest rates may be higher. Some lenders specialise in “bad credit” types of car finance.

Can I end my car finance agreement early?

Yes, most car finance agreements allow you to settle the agreement early, although there might be early settlement charges involved. You’ll need to contact your finance company or provider for a settlement figure.

Is it better to finance a car through a dealer or a bank?

It depends on your circumstances. Dealerships might offer promotional financing deals, like 0% interest rates, that can be attractive. However, banks might offer more flexibility and could have lower interest rates outside of those promotional offers.

What is ‘negative equity’ in a car finance agreement?

Negative equity occurs when the amount you owe on your car finance agreement is more than the value of the car itself. This can happen if the car depreciates in value faster than you’re repaying the loan.

[…] people take out car finance to pay for new vehicles because paying all at once is often not viable. But what happens if you […]