We are LEVC finance specialists who help drivers secure competitive funding for London Electric Vehicle Company taxis, even with poor credit histories. At Carvine, we connect you with tailored finance deals that make upgrading to an electric LEVC TX affordable, with options including zero deposit arrangements and flexible repayment terms specifically designed for taxi drivers and fleet operators.

What Is LEVC Finance and How Does It Work?

LEVC finance is specialised funding designed to help taxi drivers purchase London Electric Vehicle Company’s electric TX taxis through affordable monthly payment plans. We work with specialist lenders who understand the taxi trade and provide finance solutions for new and used LEVC vehicles.

The LEVC TX is a purpose-built electric black cab that meets Transport for London’s zero-emission requirements. These taxis feature an 80-mile electric range plus a petrol range extender, providing 333 miles total range. New TX Vista models cost approximately £70,000, whilst we can source quality used examples from around £25,000, making finance essential for most drivers regardless of their preferred option.

Finance options include hire purchase, personal contract purchase and business contract hire arrangements. We secure deals with representative APR rates from 10.51 percent, with many agreements requiring deposits as low as 10 percent or even zero deposit in some cases.

What Does An LEVC Finance Application Loan Look Like?

Simply put, a LEVC finance agreement is a financial agreement between you, the lender, and the van dealership:

- You apply on our quick application form

- The funder assesses your ability to pay the finance agreement

- A decision is made that is based on you, the asset & deposit level

- You choose the suitable LEVC vehicle.

How to Apply for LEVC Finance

Applying for LEVC finance with us is easy with our online application. You’ll receive a response within minutes, and our team will be there to offer support and expert advice all the way.

Once you hit the apply button, we will carry out a credit search to match you with your details.

One of our team will be in touch to talk you through the process. You may be asked to provide some documents such as proof of income.

We are finance specialists. This means we don’t use mainstream lenders and are fully aware that not everyone has an excellent credit score.

How Long Do I Have to Wait Before I Can Get My Black Taxi Cab?

Getting out on the road quickly is essential to your business running smoothly. Getting a loan offer in the first place is designed to be convenient and fast. It can take a few days however this is often dependent on your providing us with the required documents quickly. Please also see our page for taxi finance.

-

Can I Get LEVC Finance With Bad Credit History?

Yes, we specialise in securing LEVC finance for drivers with poor credit scores, including those with county court judgements, defaults and missed payments. Our panel of specialist lenders understand that taxi driving generates regular income and assess applications based on current affordability rather than past credit issues.

We work with funders who specifically support the taxi industry and take a flexible approach to credit assessment. These lenders recognise that self-employed taxi drivers face unique challenges and focus on your ability to maintain monthly payments through fare income.

Adverse credit circumstances we regularly help with include county court judgements, individual voluntary arrangements and bankruptcy history, provided you can demonstrate current income stability and affordability for the proposed monthly payments.

-

What Are the Key Benefits of LEVC Electric Taxis?

LEVC TX taxis offer four major advantages: zero-emissions capability for ULEZ compliance, an 80-mile electric range for city driving, wheelchair accessibility features and reduced running costs compared to diesel vehicles. These benefits translate directly into increased earning potential for drivers.

Operating costs drop significantly with electric driving. Case studies from industry-leading transport researchers show fuel costs reducing from 23p per mile in diesel taxis to around 8.3p per mile in LEVC vehicles – a saving of approximately £1,469 over 10,000 miles annually.

The vehicles are fully ULEZ compliant, avoiding the £12.50 daily charge in London's Ultra Low Emission Zone. They feature pure electric driving for city centres, switching automatically to hybrid mode for longer journeys.

Accessibility features include integrated wheelchair ramps, swivel seats and hearing aid loop systems. The spacious interior accommodates up to six passengers with exceptional legroom and comfort.

-

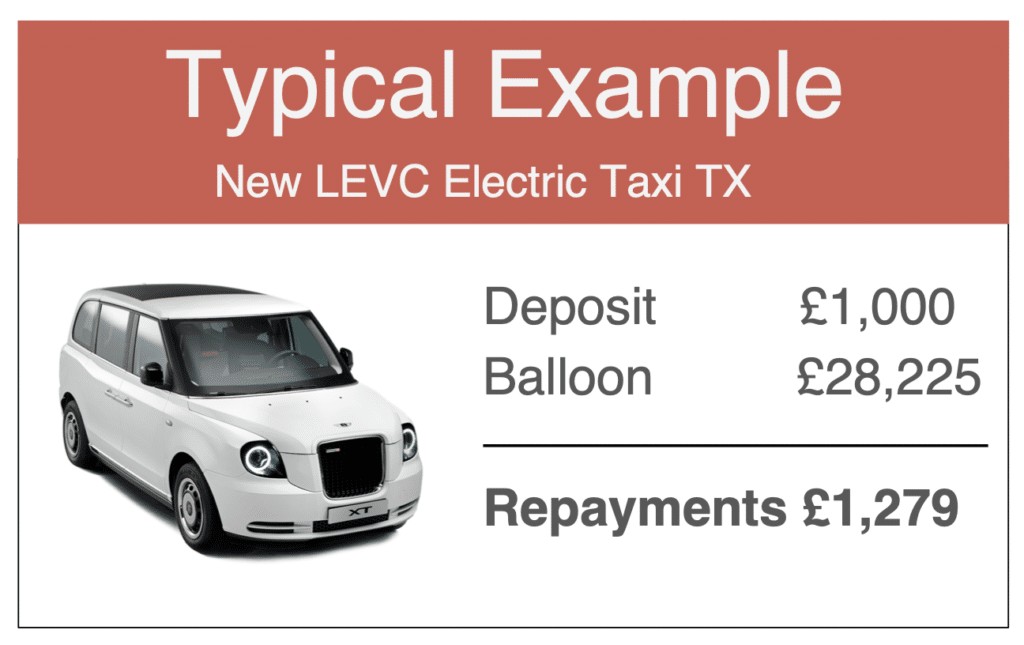

How Much Does LEVC Finance Cost Monthly?

Monthly LEVC finance payments typically range from £800 to £1,200 depending on deposit amount, term length and your credit profile. We help structure agreements that align with your expected fare income and cash-flow patterns.

Representative examples for borrowing £54,000 over five years at 20.50 percent APR show payments of £1,121.80 per month with no deposit. Lower APR rates of 10.51 percent are available through specialist LEVC finance providers, reducing monthly costs significantly.

LEVC deposit contributions of £1,500 are currently available, effectively offsetting recent reductions in government grants. This support helps reduce initial cash requirements and monthly payment amounts.

Payment terms typically range from two to five years, allowing you to balance affordability with total interest costs. Longer terms reduce monthly payments but increase overall finance charges.

-

What Documents Do I Need for LEVC Finance Applications?

Essential documents include three months' bank statements, driving licence, proof of address and income evidence such as accounts or SA302 tax returns for self-employed drivers. Employed applicants need recent payslips instead of self-employment evidence.

Bank statements demonstrate income patterns and financial management – lenders look for regular deposits and absence of excessive returned payments or overdraft usage.

Valid hackney carriage or private hire licences may be required to confirm professional taxi driving status. Some lenders offer preferential rates for licensed drivers compared to general vehicle finance.

Additional documentation might include business insurance certificates, vehicle registration documents for trade-ins and deposit source evidence if using substantial cash deposits.

-

Which LEVC Models Are Available for Finance?

We arrange finance for all LEVC TX variants including the Icon and Vista models, both featuring the same eCity electric powertrain with an 80-mile electric range and 333 miles total range. New vehicles qualify for manufacturer warranties and the latest technology features.

The TX Icon represents the standard specification with professional driving features, ergonomic seating and comprehensive connectivity options. Monthly finance rates start from competitive APR levels through our specialist lenders.

TX Vista models add enhanced accessibility features including parking sensors, wheelchair ramps, swivel seats and digital voice intercom systems, supporting drivers serving mobility-impaired passengers.

Both models use identical 31 kWh batteries and 1.5-litre petrol range extenders. The electric motor provides 148 bhp with instant torque delivery ideal for stop-start city driving patterns.

-

How Does the LEVC Finance Application Process Work?

Our streamlined application process delivers decisions within 24 hours through our four-step system: online application completion, credit assessment by specialist lenders, vehicle selection assistance and direct dealer payment arrangement. We handle all documentation and coordination on your behalf.

Initial applications take around ten minutes online or by phone. We perform soft credit searches that don't affect your credit score, followed by detailed affordability assessments with our panel of taxi-industry finance providers.

Once approved, we help locate suitable LEVC vehicles through our dealer network. New vehicles can be ordered with specific configurations, while quality used examples offer immediate availability.

Final arrangements include insurance setup guidance, delivery coordination and ongoing support throughout your finance term. We maintain relationships with customers beyond initial purchase completion.

-

What Makes Carvine Different for LEVC Finance?

Carvine specialises exclusively in vehicle finance for customers refused by mainstream lenders, with particular expertise in LEVC funding and deep relationships with taxi-industry specialist lenders. Our focus on challenging credit cases sets us apart from general brokers.

We understand the taxi trade's unique requirements and seasonal income variations. Our lenders recognise that professional drivers generate consistent revenues through fare collection, supporting reliable monthly payment capabilities.

Our specialist approach means higher approval rates for customers with adverse credit histories. We present applications in the strongest possible light, emphasising current income stability and affordability rather than past credit issues.

Ongoing support continues throughout your agreement term, with refinancing options available as your credit profile improves or when upgrading to newer LEVC models becomes appropriate.